Breakeven (or CVP) analysis is about understanding the relationship between price, volume and costs.

Price is how much we sell our goods and services for, volume is the quantity that we sell, and costs are what it costs to do that. We can make more effective financial decisions if we understand how they change in relation to one another.

You would use breakeven analysis when answering questions around investment - for instance, whether you should upgrade your equipment, what room you have to discount your goods or services, or whether you can afford to put on another employee.

There are three simple steps to use breakeven analysis to understand your financials. The first is to classify your costs according to how they behave (are they fixed or variable). The second is to calculate what your breakeven is, and the third is to use this information as a tool to make better business decisions whether you are setting sales prices, managing costs or planning for profit.

Classifying Costs

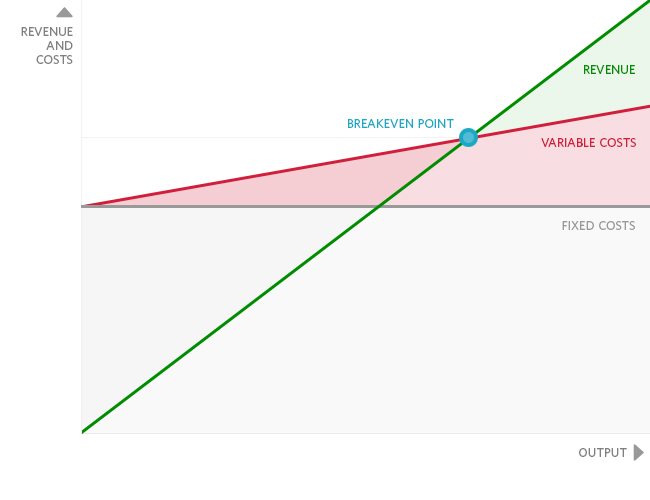

Costs in your business are either variable or fixed costs.

Fixed costs are those that occur regardless of whether you make a sale. They are things that are needed in order to operate the business. Examples of fixed costs are insurance, wages & salaries, rent or advertising costs.

The fixed costs provide us with the capacity to make a certain level of sales, but to go past that we may need more resources such as people or equipment. As sales increase, fixed costs will go up in a stepped fashion (think about bringing on a new employee for example).

Variable costs are those that occur in making a sale, and they rise in proportion to our sales. Examples of variable costs include the direct labour and materials used in providing the goods or services, commissions, packaging, royalties, or merchant fees.

To classify your costs for breakeven analysis - assign them as variable if they are incurred by making a sale, and if the cost would have been incurred anyway, it is fixed.

Once you understand your costs - you can work out your breakeven point.

Your breakeven represents the point at which you have no net loss or profit. It's the point at which you will start making a profit once your sales exceed your breakeven.

- Calculate your variable cost percentage. Variable cost percentage is the % of each sale that goes to covering your variable costs.

Variable Cost Percentage = Variable Costs / Sales

- Use this to calculate your contribution margin. This is how much you have left over from each dollar of sales to cover your fixed costs and generate a profit.

Contribution Margin = 100% - Variable Cost Percentage

- Calculate your breakeven point by dividing your fixed costs by your contribution margin.

Breakeven Point = Fixed Costs / Contribution Margin

If you are a business with a turnover of $500,000 of which you have fixed costs of $250,000 and variable costs of $100,000 -

Yay I've got my breakeven point! (what now?)

From here you can start looking at modelling how changes affect your bottom line. We will use the figures in our example earlier to look at a few different scenarios you might want to use breakeven analysis for!

What if I want to work out the sales required to meet a profit target?

To calculate the total sales required given a profit target you can use the following formula -

For instance, if you want to make a profit of $250,000 -

Target Sales = ($250,000 + $250,000) / 80% = $625,000

And what if I want to work out the sales I need to cover a new employee (additional fixed cost)?

The same formula applies if you are looking to determine the amount of additional sales revenue is required to cover additional fixed costs (for instance if you are planning on bringing on a new employee) -

For instance, if you take on a new staff member who is on a $50,000 salary -

New Breakeven = ($250,000 + $50,000) / 80% = $375,000 (an increase of $62,500)

You can use a Magic Number if you're just interested in the net additional sales required.

The Magic Number represents the ratio of breakeven sales required for each dollar of fixed cost. It's a quick way you can use breakeven analysis to make decisions in the business.

In our previous example - the new staff member on a $50,000 salary -

Magic Number = ($1 / 80%) = $1.25

New Sales = $50,000 * $1.25 = $62,500

So if we employ a new staff member, we will need an additional $62,500 in sales to cover their salary!

What if I want to assess risk in fluctuating sales figures?

You can assess risk by calculating your Margin of Safety (MoS). The Margin of safety represent the amount of a drop in sales can be tolerated by a company. A higher margin of safety means a higher tolerance to fluctuating sales. A drop in sales greater than the margin of safety will cause a net loss for the period.

Using our example previously -

Margin of Safety = ($500,000 - $312,500) / $500,000 = 37.5%

This is awesome stuff, what else can I do?

You can also use breakeven analysis to calculate the effect of pricing changes.

If you apply an increase or decrease to the price per unit, you can calculate the volume required to be sold in order to reach your breakeven point.

If you assume there are no changes to costs, then changes to your selling price affects your contribution margin. A decrease in sale price will result in a lower contribution margin, which an increase will result in a higher contribution margin. To calculate the new breakeven point you will have to use the new contribution margin!