If you've ever chased up a small business customer asking for payment only to hear the excuse - ' I never got your invoice, can you resend it', you might want to check out e-invoicing.

It's a new digital invoicing framework designed to automate many of the sticking points that currently get in the way of small businesses being paid. In this article we explore what is electronic invoicing (or e-invoicing), how to send e-Invoices in Xero, and what are the benefits for your business

What is e-invoicing?

Electronic invoicing (or e-invoicing) is the direct digital exchange of invoice information between the accounting systems of a customer and a supplier. With e-invoicing, businesses no longer need to provide paper based (or PDF) invoices as a record of sale, and customers no longer need to enter invoices into their accounting system - the process is completely digital, automated, and takes place over an open network

In Australia, the standard used for e-invoicing is called PEPPOL - which originated in Europe and stands for Pan-European Public Procurement OnLine. This framework is used globally, to standardise how electronic business documents are shared between businesses in different countries. Being a global framework, it helps support international trade and creates new business opportunities for Australian businesses into the future

It's also an open (independent) network. While the ATO are the champions of e-Invoicing in Australia, invoices are sent securely over the network and the only people that can see those invoices are your accounting platform, you, and the other party to the invoice (whether they are a customer or supplier). The tax office have no visibility over the network

Why do I need e-invoicing?

Currently, managing invoices for a business happens at two points in the accounting process - as a part of sales with your customers, and as a part of expenses with your suppliers

When making a sale, often a tax invoice is raised and either emailed to the customer or printed and provided as a physical document. Which they then enter in their accounting software (or keep a copy of to give to their bookkeeper at BAS time, and accountant at tax time) When working with suppliers, invoices for good or services provided are sent to you. Meaning that you then scan or manually enter the supplier invoice into your accounting software

In both scenarios, there is some manual data entry required that is time consuming and can lead to human errors such as entering the wrong invoice amount, the wrong bank account, or sending the invoice to the wrong person. These manual steps can create delays in invoices being processed which can impact your cashflow

Since e-invoices are sent directly between the accounting systems of each business, you know that your customers have your invoice ready to be approved and paid - improving your cashflow. You will never be told again - 'I never got your invoice'. And it will reduce your time entering and processing supplier invoices in your accounts, saving you money

If you deal with Australian government agencies there's an additional reason to implement e-invoicing. Under the Digital Business Plan, the government will mandate e-Invoicing for all agencies by July 1, 2022 - and when you submit an e-invoice under $1 million, you'll be paid within 5 days

To summarise the benefits of e-Invoicing -

- Reduce data entry errors

- Save money by reducing manual entry, follow-ups and fixes

- Improve your cashflow, by knowing that invoices are there ready to be paid

- Reliable and secure entry of invoices into your customers' accounting system

How do I start sending e-invoices in Xero?

e-Invoicing has been available in Xero for Australian businesses for a while now, you may have noticed it within the 'new invoicing' format. It's also available in Xero for customers in New Zealand and Singapore. Xero as part of its acquisition of TickStar will take care of ensuring your business is e-invoicing ready and on the Peppol network

Follow these 4 steps to send e-Invoices from Xero -

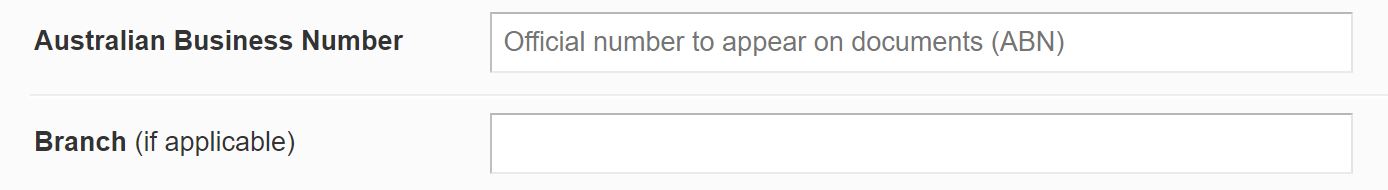

- Add your ABN, branch number (if applicable) and registered business name into your Organisation Settings in Xero

- Add the ABN of your customer in their contact details in Xero

- Confirm that your customer is registered to receive e-Invoices in the Peppol directory

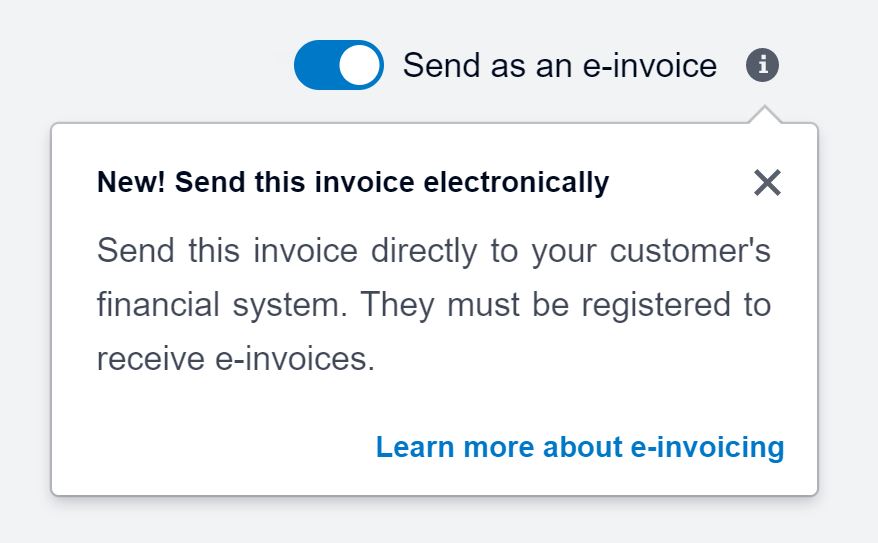

- Tick the 'Send as e-Invoice' toggle when sending an invoice from new invoicing in Xero