Preparing and lodging your Business Activity Statements (BAS) can be a complex process. It's also important to get right the first time to avoid making corrections later, and potential penalties. We step you through the process of doing a BAS reconciliation in Xero

Why reconcile your accounts?

Reconciliation is an accounting process of comparing two sets of records to check that the figures are correct and agree with one another. By reconciling your accounts, you are matching the transactions in the accounting system to external records such as invoices, bills, receipts and statements to ensure that the tax treatments in your numbers for reporting purposes is correct

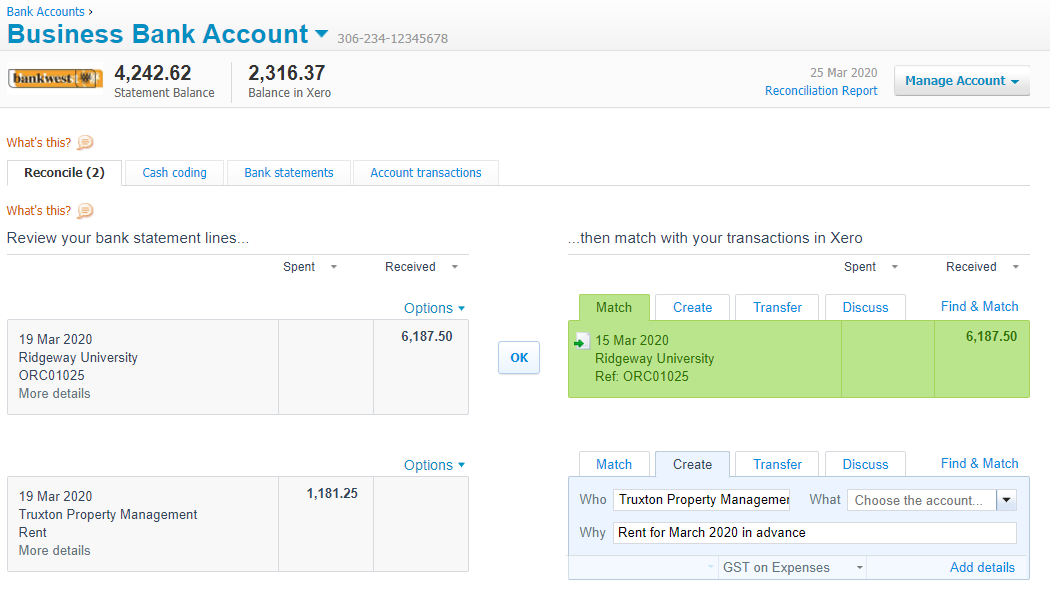

How to reconcile your bank accounts

-

Match to existing (or create new) transactions for all statement lines in all bank accounts

-

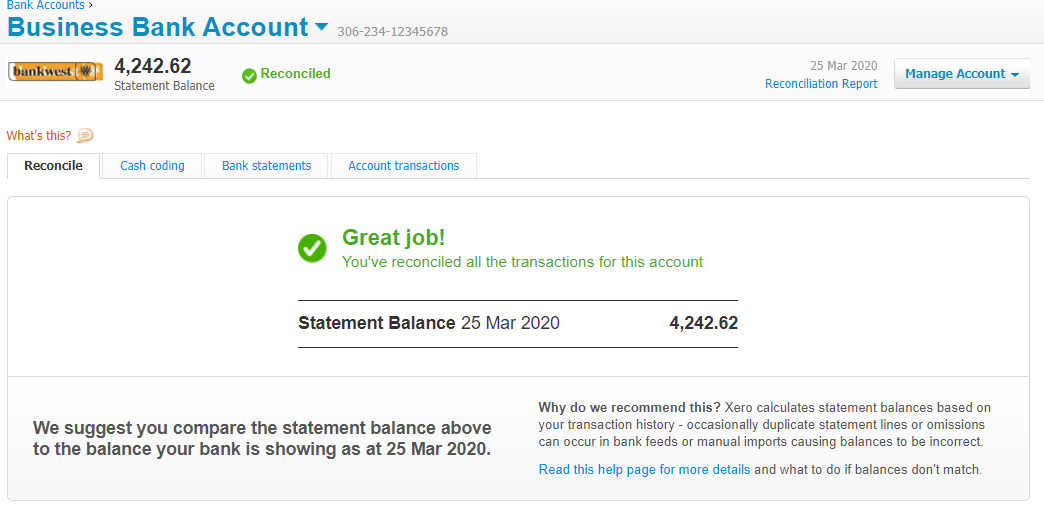

Ensure that your Statement Balance is the same as your Balance in Xero for each bank account

Check your statement balance for each bank account against the balances in Xero

Account for all non-bank transactions affecting the BAS

Enter all unpaid Invoices and bills (if you report GST on an accrual basis, the GST relating to these transactions is reportable)

Enter all business expenses paid for by other means, such as expense claims paid on a personal card or account

Record all non-cash adjustments affecting GST - such as writing off bad debts, adjusting transactions for private use, and accounting for gift cards and vouchers

How to reconcile your GST

-

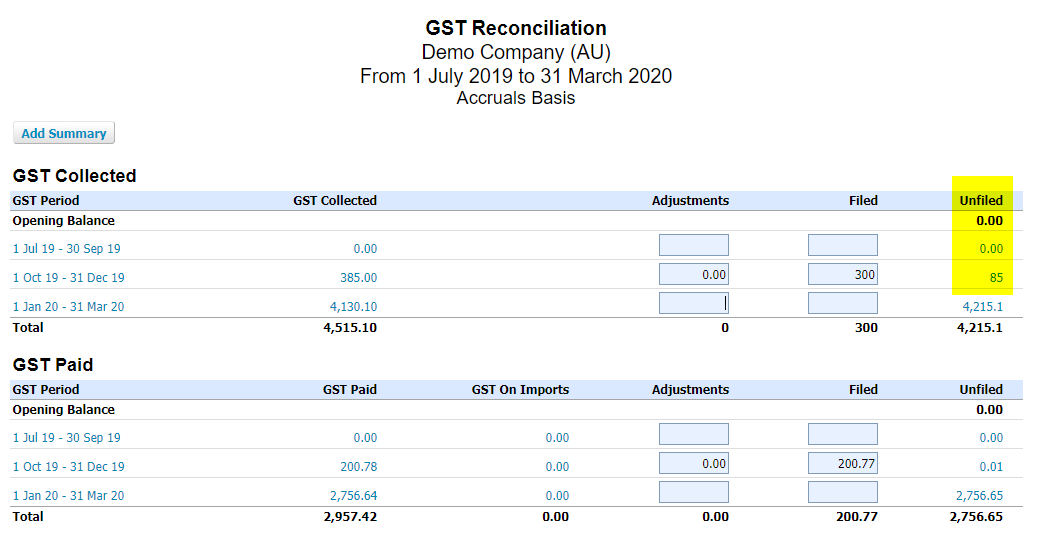

After all cash and non-cash transactions are accounted for and verified, and before the BAS lodgement can be done, it’s important to reconcile your GST account

Publish/finalise all prior period Activity Statements in Xero

Make sure to check your GST reporting frequency - lodging your BAS quarterly is common for smaller entities

Run the GST Reconciliation report

Xero recommends selecting a From date that gives an opening balance of 0 on your report

Note prior period variances - if you have any, find out why and either revise the Activity Statement for the offending period or adjust in the next BAS (refer to ATO guidelines on adjusting GST)

Check your Integrated Client Account balance with the ATO, and make sure any non-zero balance is reflected in your accounts (such as penalty interest, unpaid prior period liabilities and previous payments)

If you report GST on a cash basis, note that the GST in Accounts Receivable and in Accounts Payable should be the difference between GST reported on the BAS and GST in your general ledger account for the period

How to reconcile your PAYG withholding

Compare you Payroll Activity Summary report to your Activity Statement report for gross reportable wages and PAYG withheld

Check for any non-standard withholdings, such as eligible Employment Termination Payment (ETP) withholdings - these are still reportable at W2 on the BAS

Check your PAYG withheld liability account reconciles

Prior period withholdings should have either been paid to the ATO or cleared off to another liability account (to match the Integrated Client Account), so all that’s left is the current period amount

This should match your reconciliation of the Payroll Activity Summary and the BAS

Common reconciliation problems when doing your BAS

Bank Reconciliation variances

Unreconciled bank statement lines

match or create transactions for theseUnmatched account transactions

Remove these if they don’t match bank statement lines and are in error

If they are for as-yet uncleared bank transactions, either re-date or leave and recognise what they are for

Missing bank statement lines

Import the missing bank statement lines

There may have been a glitch with the bank feed, or the feed didn’t start prior to the beginning of the period

Duplicate bank statement lines

Delete the duplicates

PayPal feeds are known to import duplicates

Bank statement lines may also have been manually imported for periods after the direct feed became active

Incorrect conversion journal

Starting balance of bank accounts is incorrect

Date of conversion journal doesn’t match with start of bank transactions in Xero

Make sure the bank account balance in the conversion journal matches the bank statement balance, and that only bank statement lines since the conversion date are imported

GST and BAS Reconciliation variances

Make sure you have the correct GST reporting option (cash or accrual) set up in your Xero file, matching your GST registration with the ATO

The GST reporting option in Xero has been changed since the last BAS was filed

There is a date mismatch on bills or invoices. Check if the bill or invoice date is in a future BAS period but the applied payment is in the current BAS period

Transactions with GST implications in prior BAS periods have been changed after the prior BAS was lodged

Not all prior BAS reports have been published in Xero - for older (full) BAS

For New Activity Statement (simpler BAS), not all filed figures from 1A and 1B in the previous reports have been populated

Manual journals affecting the GST account have been posted (likely by your Accountant)

Where to next?

If you're stuck and need a hand reconciling your BAS, get in touch we can help by looking over the accounts with you to see what's out, or lodging it for you